The Ohio Health Insurance Exchange, created by the Affordable Care Act, offers affordable medical plans for you and your family. Review and compare the best rates and quotes on our website, and read current information about federal subsidies and how they can lower your premium. Open Enrollment begins November 1 and ends December 15th for guaranteed medical benefits. High-deductible and low-copay plans are available. Special pandemic OE periods (COVID) were also created to help consumers obtain low-cost coverage.

You can also apply for 2021 Marketplace coverage online without paying fees or commission. Single, family, and small businesses can enroll in less than 20 minutes. Multiple customized policies can be reviewed with various copays, coinsurance, and deductibles. Standardized Senior Medicare Supplement plans are offered to applicants that have reached age 65 and are Medicare-eligible. No medical questions or physicals are required, and Part D prescription drug plans are also available.

Setting up the Exchange (Marketplace) was very expensive. So Ohio, like many states, allowed the Federal government to implement the setup and implementation. Since it saved about $40 million, it made economical sense to let someone else pay the expenses. And that doesn’t include the staggering $350 million that the Affordable Care Act legislation forced Buckeye State residents to pay. Although states can create their own Exchange (The Pennsylvania Exchange “Pennie” began operations in 2021), most states utilize the Federal Government to operate their Marketplace.

Under the current and future Administrations, major changes are not expected, although Congress may create, review, debate, and approve an alternative. Ultimately, we believed the US Department of Health And Human Resources would be heavily involved in the creation of plans and we were correct. Previous Governor John Kasisch had originally indicated that there will be a “partnership” arrangement that allows the state to maintain some control over some of the management and consumer relations functions.

The total enrollment of private plans through the Exchange is listed below:

2014 – 154,000

2015 – 234,000

2016 – 243,000

2017 – 238,000

2018 – 230,000

2019 – 206,000

2020 – 196,000

2021 (est) – 200,000

How Does It Impact Us?

So what does this mean for you? Until six years ago, there were no changes to the way you purchased your coverage. This website is still the best resource to buy a policy. However, after that date, it was legally required that you must buy health insurance. This was called “the mandate,” which the Supreme Court subsequently upheld. Although your age and zip code still impact your rate, smoking status no longer make as large of a difference.

The non-compliance tax originally was $95 per adult (and $47.50 per child) or 1% of income (whichever is larger). Penalties gradually increased to $695 per individual (and $347.50 per child) or 2.5% of income. Thus, if household income was $100,000, the tax for not purchasing a compliant policy was $2,500. Effective two years ago, the tax penalty was repealed. It is not expected to return under the Biden Administration.

What About The Federal Subsidy?

Depending on your individual or household income, tax credits could lower your premium. Using Franklin County as an example, typically, a four-person household (ages 45, 45, 18, and 15) with income less than $180,000 will receive some assistance, although the ages of the applicants can impact the amounts. You may also qualify for Medicaid, which can potentially pay all of your premiums, while providing comprehensive benefits. For example, utilizing the increased subsidy amounts, a married couple (ages 30) earning less than $24,000 per year will qualify. A single person (age 30) earning less than $17,000 should also qualify.

This situation has been debated by members of Congress and no bipartisan resolution has been enacted yet. Each state is able to adjust its own Medicaid eligibility requirements. Thus, it is possible that if you move from one area of the country to another, your benefits could change. If eligible for Marketplace plans, carriers, plan offerings, and subsidy amounts will likely differ.

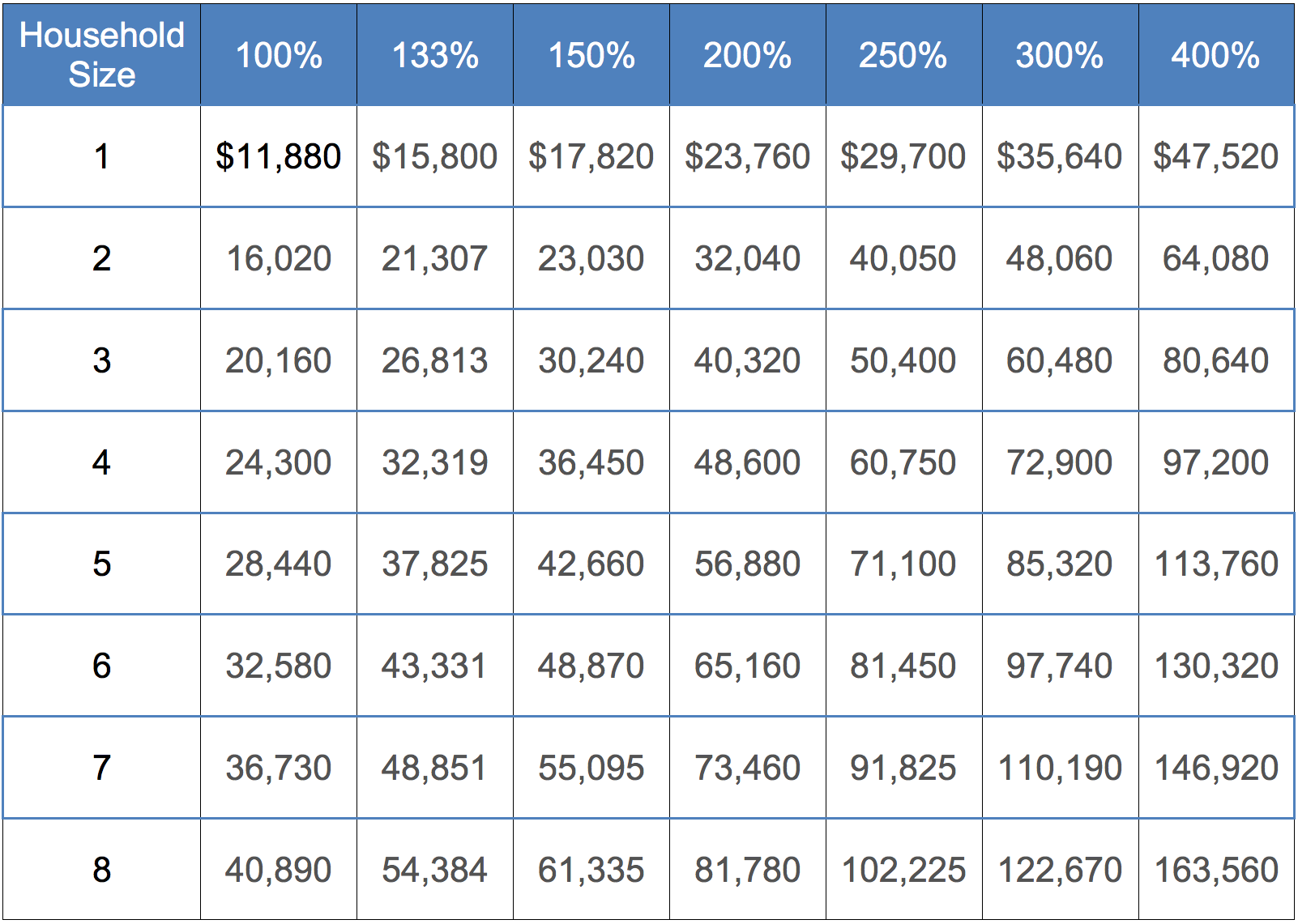

The credit is paid to households who can document that their income is between 100% and 400% of the “Federal Poverty Level.” Older persons will receive higher credits. Naturally, if you are eligible for Medicare or Medicaid, you will not receive the credit. Often, when children move out of the household, the eligibility will change, with less income required to receive a subsidy. Individual plans on persons that have reached age 26 (or younger) are very affordable and available from most carriers.

For example, a family of four (Ages 50, 50, 18, and 16) that lives in Hamilton County (Cincinnati area) with $60,000 of household income will pay about $15 per month for the least expensive Bronze-tier coverage. The cheapest Silver-tier plan will cost $313 per month. This does not include deductibles, copays or coinsurance. This publication provides specific details. The graphic below also shows you the specific FPL levels.

Available Plans Decreasing

Eight years ago, the number of available plan options to consumers reduced from about 300 to about 50. With Humana, UnitedHealthcare, Premier, and Aetna exiting the Exchange, less plans are offered. The four levels of benefits continue to be classified as Platinum, Gold, Silver, and Bronze. These plans typically cover 90%, 80%, 70% and 60% of your anticipated expenses respectively. A special low-cost catastrophic option is offered to low-income households, although you must prove “financial hardship.” Anthem currently offers private coverage in selected counties.

“Silver” plans have special “cost-saving” features that offer special subsidy incentives (lower deductibles, copays and coinsurance) if you meet the “250%” rule. If your income is less than 250% of the Federal Poverty level, you will be rewarded with these lower out-of-pocket costs. Since the “Silver” plan is considered the “benchmark” option, only these plans receive the special treatment.

Please ask us about details regarding the cost-sharing features of Silver-tier plans. If you qualify, it can potentially save you thousands of dollars if you incur a large claim throughout the year. And perhaps the best part – It does not cost anything to utilize. But the right plan must be chosen. Popular Silver-tier plans in Ohio include Ambetter Balanced Care 12, Ambetter Balanced Care 29, Oscar Silver Saver 2, Molina Constant Care Silver 4 250, Anthem Silver Pathway X HMO 6900 25, CareSource Marketplace Low Premium Silver, SummaCare Silver 6000 and Medical Mutual Market HMO 4000 HSA.

The Best Available Plan?

Which type of plan will be best for you? Of course, we will help you make the best decision, but HSAs are very popular and cost-effective if you rarely incur medical expenses. The combination of tax breaks and low prices will make these types of policies more popular than ever before. Deductible and plan availability is limited in some areas. Humana and Aetna offer very attractive HSA options, but they are only available on small or large Group plans. Anthem offers an HSA in selected counties. The Anthem Bronze Pathway HMO 6850 0 for HSA provides no coinsurance or out-of-pocket expenses after the deductible has been met.

When multiple pre-existing conditions are present (or a chronic condition), it becomes more critical to properly compare the most appropriate policies. For example,if a policyholder was prescribed a very expensive medication such as Accutane at a cost of about $400 per month, the RX benefits should cover non-generic drugs. By spending an extra $30-$40 per month on the the most appropriate plan, you may save thousands of dollars.

Buying A Plan Outside Of The Exchange

Because of the Department of Health And Human Resources guidelines, you may have to accept several additional benefits that you are unlikely to utilize. “Mandated” benefits can not be removed from the policy, and often increase the rate by as much as 10%-30%. For adults between the ages of 55 and 64, the increased premium can be quite substantial. Applicants that qualify for a large federal subsidy will pay much lower premiums that high-income households.

For example, all policies must include pediatric vision and dental benefits, regardless of whether you have children. These are defined as “mandated” coverages and can not be removed. It is hoped that future legislation will be passed that allows consumers to “opt out” of these restrictive, and sometimes costly benefits. Although the current maximum deductible is $8,550, it is possible that additional catastrophic plan options will be offered to any applicant (instead of applicants under age 30), and with higher optional deductibles.

Short-term policies are purchased outside of the Marketplace and are available at any time. If you miss Open Enrollment, they are a very popular method to secure coverage until the next period (Begins November 1). Although temporary plans are incredibly cheap, they do not cover most pre-existing conditions and do not qualify for a subsidy since they don’t contain many of the Obamacare required benefits. Coverage is offered in 1-12 month increments, although multiple plans can be purchased. 12-36 months of continuous coverage is available through selected carriers.

I Own A Small Business

Small business owners are helped by the Small Business Health Options Program (SHOP). This option provides employees of small businesses opportunities to purchase coverage. Plan choices are different each year, and not all insurers participate. Companies with 50 (or fewer) employees are eligible for benefits. An “FTE Calculator” is provided to help determine the number of full-time employees within the company.

Plans do not have to be made available to part-time workers or seasonal employees. Ohio also does not have a participation requirement, so the percentage of employees that choose to accept benefits is not a factor. Note: After enrolling, if the number of employees exceeds 50, you may continue to renew coverage. Each year, it is possible that new companies will offer Group coverage, and existing plans may change.

And of course, you can count on live experienced unbiased help when you apply for health insurance in Ohio. We work for you, not the government! And all rates and quotes you view are free, and constantly updated. When carriers change policy prices or availability, we make the appropriate adjustments.

If there are tax ramifications, we provide the most recent and updated information, so you make the correct decision. Since pre-existing conditions will not be considered, all applicants will likely qualify for a policy (assuming you are a US citizen). When filing your federal tax return, submitting proof of compliant coverage is not required. However, you may receive one or more of the following four forms, which provide needed information for submitting your taxes.

Form 1095-A – If you were insured by a Marketplace plan, this form will be sent to you. It includes specific details regarding your effective date, premium, and tax subsidy, if applicable. The information contained on the form will be needed to submit Form 8962 (Premium Tax Credit).

Form 1095-B – Carriers provide this form to covered persons listed on the policy. The form also provides proof that the “individual shared responsibility provision” has been met.

Form 1095-C – Employers provide this form to employees that receive “self-insured coverage.” The information helps determine if the workers are eligible for a federal subsidy.

Form 8965 – For persons that qualify for an exemption of the “individual shared responsibility provision,” this form must be submitted with your federal tax return.

Tax credits, as previously mentioned, may help reduce your costs. They are paid directly to the insurance company, who immediately reduces the premium. You do not have to wait for a refund or check in the mail. These reductions are directly applied, and often result in hundreds of dollars of savings each month.

All rates and plan details you view through the website are current, and you can still apply for plans at the lowest published rate. Although the online link we provide is the easiest way to get covered, upon request, we’ll fax or email you an application. We will also help you enroll (if needed) through the .gov healthcare website. Typically, only one application is needed for an entire family. Note: If two persons are applying for Senior Medicare Supplement or Advantage coverage, separate applications may be needed for each applicant.

UnitedHealthcare and Aetna Coming Back In 2022?

Not all carriers are offering private individual plans in the Buckeye State for 2021, although many companies remain very active with Senior and Group business. UnitedHealthcare and Aetna are two examples. These companies chose to skip State Exchanges until financial stability and predictability returns. They have stated that under the current legislative and fiscal environment, it would be difficult to offer competitive prices and remain profitable in the individual marketplace. UnitedHealthcare has returned to several states.

Healthspan, (formerly Kaiser) was a “new player” to the Marketplace and they offered many low-cost options, especially in the Akron, Canton, Toledo and Cleveland areas. The “3000-80” plan was one of the cheapest options in the Buckeye state. The plan was also popular in the Cincinnati area where the rate was one of the lowest available in Hamilton and surrounding counties. However, they also exited the Marketplace.

Also, InHealth, a non-profit co-op, that received funding from the federal government, no longer offers private plans in the Buckeye State. Nationwide, co-ops have performed poorly, despite millions of dollars of federal aid.

What Are Navigators?

Recently, many states have been evaluating the effectiveness of “Navigators” who have very limited training of product options and tax ramifications. For those reasons, they are prohibited selling or marketing health insurance plans. They also are not allowed to offer their advice regarding plan selection or description.

About 70 navigators were expected to be hired with either state or federal tax dollars. However, none were properly certified, and therefore could not be utilized when the initial Open Enrollment began. Since they are not screened or licensed, most consumers choose not to use their services, especially since they are provided access to personal financial information.

Funding for the Navigator program was slashed, since the overall effectiveness was questioned. The Centers for Medicare and Medicaid Services also reduced their advertising budget ($100 million to $10 million) for Open Enrollment promotions. However, digital and radio advertising, along with email programs continue. although the effectiveness is difficult to measure.

The “Ohio Association Of Food Banks” is one of the outreach organizations that will try to to have more than 30 workers certified. But like most “navigators,” their level of expertise will be very limited and tax and subsidy issues will not be discussed.

Brokers Are Still The Best Option

Most consumers do not utilize a navigator’s services, especially when websites like ours, along with experienced brokers, are available. Typically, the average person prefers to work with a veteran agent/broker that can make specific unbiased recommendations and has perhaps decades of training and continuing education. Enrollment is simple and if needed, plans can be quickly and automatically renewed.

Most enrollment business is done online, which saved consumers time and improves accuracy. We’ll keep you completely updated and make it easy for you to apply for health care benefits. We are a top private consumer website and are not affiliated with the Department Of Insurance or federal government. We compare all options, find the best plans (price and coverage) and make it easy to enroll.